Download our app

start your loan

application with smartly

Instant Mudra focuses on all kinds of personal loan in India mobile users to fulfil their petty Instant loan demand by providing them personal loan in India from Rs 3,000 to 30,000.

- quick loan process

- very low rates

Professional Services

Professional working between you and our executives is our priority.

Low costing

We provide instant quality services at low cost.

Live Support

Here, at Instant Mudra, you're invited to apply 24X7 online. Just apply anytime! Anywhere!

Safe and Secure

We assure about security of all your personal details.

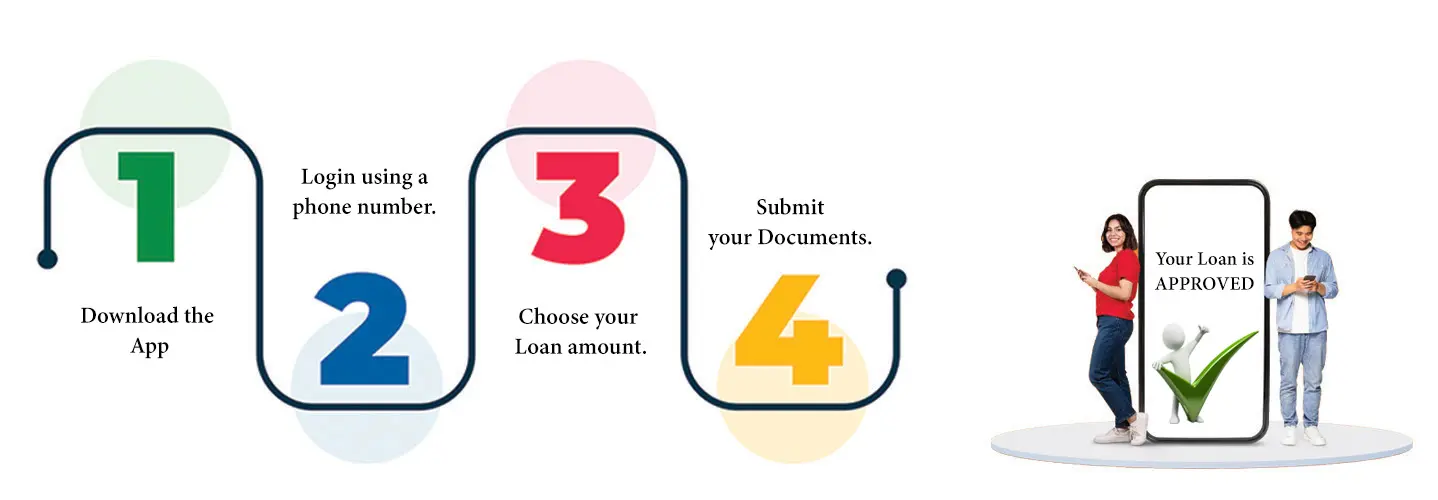

how it works

our working process

Frequently Asked Questions

An Instant Personal Loan is a quick and easy loan offered without collateral. With Instant Mudra, you can borrow between ₹3,000 and ₹30,000 at a low interest rate.

Repayment tenure ranges from 15 to 30 days, depending on the loan amount and your preference.

Yes, a small processing fee (up to 15%) is charged and clearly disclosed during the application process.

Customer Reviews

Real experiences from our loan customers

Kritika Mishra

BangaloreMy Experience With Instant Mudra Is Too Good Staff Named Kanika Helped Me Alot To Get The Amount Disbursement, Would Like To Suggest This App To Get Short Term Loan In Same Day Credit Without Any hassle.

Tripti Bhandari

DelhiI Am Very Satisfied With Instant Mudra, As It Helped Me To Improve My Cibil Score. And Gives The Opportunity To Get The Loan In Very Minimal Documents.

Shristhi Tanvar

PunjabStaff Is Very Polite And With Their Customer. And If Any Issue In Payment, Team Also Co-operate With Them And Understand The Situation And Support.